What You Need To Know About The Follower Investor Personality

Individual differences in characteristics and behavior manifest themselves in investing decisions. When you opt to invest, you must commit your resources and wealth to the venture and understand your investing nature and behavior. People with the Follower Investor personality are passive and follow their friends and peers, as well as current trends, and invest because it is being done by “everyone.”

5 Traits of the Follower Investor Personality

1. Carefree Attitude

Followers have a relaxed and carefree attitude towards life. They trust others and can be easily convinced. Such investors are sociable and get along with people. Their trusting quality also attracts many friends and a broad network of people. However, this quality may cause trouble when they make faulty investment decisions.

2. Passive Nature

Because of their carefree approach to life, follower investors are not genuinely interested in investing, so they need to be influenced to invest. They are motivated by other people, such as their spouse, a friend, salesperson, or relative. Their lack of interest in investing may prevent them from conducting due diligence. A follower in such a situation will incur losses when things fail.

3. Keeping Up With the “Joneses”

Another reason these investors are called followers is their need to keep up with others. They want to be involved and not left out. They feel they should share in the investing journey towards financial freedom. This trait encourages them to seek financial advice from everyone—family, friends, and those who seem to know about investments—everyone except professionals.

4. Easily Misled by Information

Followers have sources they implicitly trust; therefore, they are susceptible to believing false or unverified information. If the information sounds logical and true, a follower is likely to act on it. Follower investors are described as people with a herd mentality—investors waiting to hear about a lucrative opportunity and impulsively invest. Investment ideas are even more appealing to them if people try it and are successful. Followers are led by impulses rather than reasoning and critical thought. If someone has an idea, they will try it.

5. Lack Long-Term Investment Plans

While others are interested in long-term planning and thinking critically about an investment idea, a follower does not see this as essential. A lack of planning often causes followers to miss out on an investment’s full potential. A lack of determination often causes followers to miss out on opportunities. They do not see the value in seeking opinions from professional financial advisors.

Positive Attributes of Follower Investors

Flexibility

Followers are flexible in their thinking and actions, which allows them to follow others in the investment markets. This trait benefits them when lucrative opportunities arise. They will be willing to take them, especially if financial advisors verify their viability. For example, followers often purchase or build commercial property in a developing area on the assumption that “everyone is doing it.” Although not all investment opportunities are promising, followers are willing to take a risk and join the investment bandwagon.

Agreeableness

In the five-dimension personality model, followers are likely to be agreeable or open people. Such people are accommodative and can make good investment partners. It is easy to reason with and persuade them to consider a specific investment opportunity. They are trusting and do not have many rules governing their lives. If an investment idea sounds logical and beneficial, they will pursue it.

Open-Minded

Because followers have an open mind, they have the potential to accumulate wealth. They can gain success by following people with new ideas. They may not be particularly interested in investing, but whatever excellent opportunities they choose will be rewarding. A follower is not keen on making long-term plans for investments. This issue can be addressed later, especially if an investment offers good returns.

Excellent Team Players

Followers make ideal team players in group investment planning. They will support good ideas others suggest because they are not initiators. While it is usually difficult to gain consensus while working in a group, followers make that task seem effortless. Followers are more relaxed, carefree, and happy. This attitude is vital for dealing with stressful investment situations, and they can boost an investment group’s morale. Followers remain composed even in a crisis. Flexibility and openness are important traits for people who enjoy new experiences and adventure in the investment world.

Shortcomings of Followers

Exposed to Risks Due to Herd Mentality

A herd mentality can be risky, especially in situations involving scams. Followers do not consider and evaluate their decisions; they are ready to plunge in because the crowd is doing it. That is how investors have lost their money in Ponzi schemes or duped by high-yield, quick-return ideas. Eventually, they experience losses by making such decisions.

Poor Planning

A follower may have an excellent opportunity to invest but does not reap the benefits because of lack of planning. For example, purchasing stocks or shares is a good idea, but an investor should have a plan. Most followers who choose this idea get minimal yields because they lack strategy. Others miss opportunities for buying or selling because they lack knowledge about the purpose of and need for planning.

Avoiding Due Diligence

While followers may benefit from flexibility and openness, the same traits increase their chances of incurring losses. Followers rarely conduct due diligence when presented with an idea. When followers implement a bad investment decision, they experience losses because they did not thoroughly evaluate their choice.

Follower investors generally do not take the initiative and create new ideas, significantly hindering their potential to use their abilities. They may not be interested in investments, but even a little effort would make a significant difference. Lack of initiative can become a weakness in their lives. Followers are capable of mitigating their limitations as investors by researching and performing due diligence.

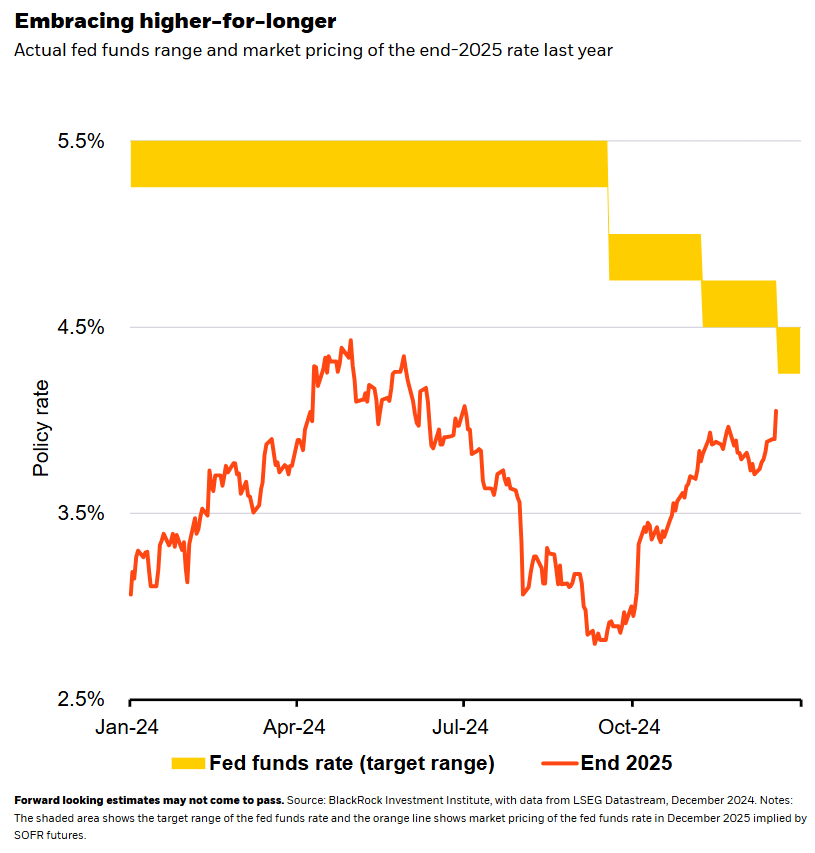

You have a 72% chance of making money in stocks in 2025

There’s a 73% probability the U.S. stock market will rise in 2025. These odds seem too good to be true, of course, since the market this year has already produced a well-above-average return — 28.2% as of Dec. 16, as measured by the Vanguard Total Stock Market ETF VTI+0.14%.

That’s triple the U.S. market’s average calendar-year return of 9.2% going back to 1794 (according to the database constructed by Edward McQuarrie, an emeritus professor at Santa Clara [Calif.] University).

Yet the market’s odds of rising in a given year are remarkably indifferent to what came before. Based on all calendar years in McQuarrie’s database, the market’s odds of rising in any given year are 73%. Following calendar years in which stocks rose, those odds are a statistically indistinguishable 72%.

What about five-calendar-year periods over which the market rose? Those odds would apply to 2025, since over the past five years the Vanguard Total Stock Market ETF has produced a 14.9% annualized return. The odds of the market rising in a calendar year following five-year gains are once again statistically similar — 72%.

What are the odds when coming off decade-long advances, such as the last one — over which the Vanguard ETF has produced a 13.4% annualized return. Following 10-year periods in which the market rose, the odds of the market rising in the subsequent calendar year are 73%. (These odds are plotted in the chart above.)

A gambling analogy helps illustrate what these statistics mean. Ask yourself: What odds would you place on a coin flip coming up heads if it had come up heads in each of the five previous flips? Or if the previous five flips had each come up tails? Many of us give different answers to these two hypotheticals, as if the odds that apply to the sixth flip have anything to do with what came before. They do not, of course, since the coin has no memory: The odds of that sixth flip coming up heads are always 50%. To think otherwise is to be guilty of what is known as the gambler’s fallacy.

It makes theoretical sense that the same is true of the stock market. If the odds of the market rising in a given calendar year were actually correlated with what had come before, then shrewd traders wouldn’t wait until January of that next year to exploit that correlation. They would instead place their bets in the preceding November or December, with the consequence that the gain or loss that otherwise would occur in that year would be transferred to those prior months. The net effect would be the correlation’s disappearance.

You may have other reasons to expect equities to do particularly well or poorly in 2025, of course. The stock market is extremely overvalued, for example, according to almost any valuation measure with a decent long-term record. But valuation only exerts its gravitational pull on the market over long periods of time, such as a decade. Over shorter periods, including calendar years, valuation indicators have relatively little predictive ability.

The bottom line? Based only on how the stock market performed this year, the odds of the stock market rising in 2025 are no higher or lower than they would be if equities were currently sitting on a big year-to-date loss.

Stock Picking Success: Batting Average Or Slugging Percentage?

The passing of Pete Rose this year brought to mind the discussion of batting average versus slugging percentage for stock selection and portfolio management. Pete Rose had a lifetime batting average of .303 with 4,256 hits in his 24-year baseball career. This means he got a hit almost once in every three at-bats, which is an outstanding result but doesn’t get him into the top ten all-time for Major League Baseball. According to MLB, Josh Gibson holds the record for the highest career batting average at .372.

On the other hand, Babe Ruth has the all-time highest slugging percentage at .6897, with a batting average of .342. The slugging percentage measures the total number of bases a player gets per at-bat, so it considers the player’s power rather than counting all hits the same as with the batting average. Interestingly, Babe Ruth also failed a lot, striking out 14.4% of the time he was at the plate. Pete Rose, by contrast, had a very low strikeout percentage of 8.1%.

So, what does all this have to do with picking stocks and managing stock portfolios?

Despite having a Babe Ruth-like slugging percentage, the U.S. stock market has a high strikeout average. According to a fascinating paper by Hendrik Bessembinder recently examining the returns on 29,078 U.S. stocks from 1926 through 2023, over half of all stocks, 51.6% to be precise, had negative cumulative returns. How does the stock market have long-term nominal and after-inflation returns higher than any other asset class while more than half of the stocks fall in value while publicly traded?

PROMOTED

The complex mathematical answer is that stock returns have strong positive skewness. However, a simple example of long-term positive compound returns provides an easier-to-digest answer. Take a portfolio of just two stocks selling for $100 per share. The first stock grows at 9.8% annualized, while the second stock falls by 9.8% annualized over thirty years. One would think our total portfolio would stagnate during that period since the losses in one stock would offset the other, but compound returns make our intuition incorrect. The exponential return on our positively performing company outweighs the loser. This portfolio grew to be worth $1,657, a 7.3% annualized rate. In other words, the highest-performing stocks more than compensate for the losers over time.

Investing Digest: Know what’s moving the financial markets and what smart money is buying with Forbes Investing Digest.Sign Up

By signing up, you agree to receive this newsletter, other updates about Forbes and its affiliates’ offerings, our Terms of Service (including resolving disputes on an individual basis via arbitration), and you acknowledge our Privacy Statement. Forbes is protected by reCAPTCHA, and the Google Privacy Policy and Terms of Service apply.

Pick your player: Pete Rose or Babe Ruth?

All other things being equal, you would pick Babe Ruth for your team since his power more than made up in production for the strikeout. Frankly, you would want both on your team if you could. But should investors seek a high batting average or swing for the fences? In his book More Than You Know, Michael Mauboussin provides a robust rationale that one should also strive to be the Babe Ruth of investors.The video player is currently playing an ad.

He notes that “the frequency of correctness does not matter; it is the magnitude of the correctness that matters.” The dollar change in a portfolio counts as success in investing, not the percentage of stocks with a positive outcome. Much like the stock market as a whole, a successful investment portfolio typically has exceptional stocks that more than overcome the subpar returns of the duds.

Crucial Implications For Investors

Mauboussin notes that investors must consider probabilities when investing in a stock since we know that significant losses and winners in a few stocks are the likely drivers of success versus failure in investment excellence. He quotes the late, great Charlie Munger speaking about the thought process of Berkshire Hathaway’s (BRK/A, BRK/B) Warren Buffett, “Take the probability of the loss times the amount of possible loss from the probability of gain times the amount of possible gain. That is what we are trying to do. It’s imperfect, but that’s what it is all about.”

Trying to hit home runs does not mean buying the riskiest stocks. Contrary to academic teaching on the subject, riskier stocks, as defined by higher volatility, do not provide investors with higher returns. Furthermore, a few lethal losses can destroy the performance of a portfolio. While Buffett began his investing career buying “cigar butts,” low-quality but cheap companies with one more “puff” left in them, he evolved to focus on higher-quality companies with Munger’s influence. Buffett now says that “it’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

According to Howard Marks, Warren Buffett, the greatest investor of all time, is credited with just twelve sensational winners in his career. Charlie Munger told Marks that the “vast majority of his own wealth came not from twelve winners, but only four.” The key was to find and hold onto those winners while avoiding significant losses. Alas, in the words of Warren Buffett, “investing is simple, but not easy.”