Unlocking Investment Success: The Power of a Mentor

by Jack Laffan

Today, I’m going to show you the transformative power of having a guide or mentor in your investing journey. Just like navigating a complex trail requires a seasoned guide, navigating the stock market requires the insights and wisdom of a mentor. The right mentor can offer you a roadmap to success, helping you avoid common pitfalls and accelerate your learning curve.

Unfortunately, many aspiring investors embark on this journey alone. The complex world of investing, brimming with jargon and intricate strategies, can be daunting for newcomers and seasoned investors alike.

Many believe they can go it alone, underestimating the value a mentor can bring.

Other reasons include:

- Overconfidence in one’s ability to navigate the market without guidance.

- The perception that finding a mentor is too difficult or costly.

- A lack of understanding of how a mentor can provide personalized insights.

- The belief that online resources and tools are sufficient.

But here’s the good news: overcoming these obstacles is not only possible, but it can also be incredibly rewarding.

Here’s how, step by step:

Step 1: Recognize the value of mentorship in investing.

It’s crucial to understand that investing is not just about numbers and charts; it’s about making informed decisions under uncertainty. Reflecting on my own experience, having a mentor was like having a lighthouse guiding me through a stormy sea. A mentor’s experience can illuminate your path, helping you navigate through complex decisions with greater confidence. Warren Buffett, one of the most successful investors of all time, had Benjamin Graham as a mentor. Buffett once said, “The best investment you can make is in yourself.” And what better way to invest in yourself than by seeking the guidance of a mentor?

Step 2: Find the right mentor who aligns with your investing goals and style.

This is where many go wrong by either choosing the wrong mentor or not actively seeking one at all. Think about what you want to achieve and your preferred investing style, then look for a mentor who has walked that path successfully. My journey in surf lifesaving taught me the importance of having a capable and experienced mentor. Just as my surf lifesaving trainer tailored our training to each individual’s strengths and weaknesses, your investment mentor should provide personalized guidance that caters to your unique financial goals and risk tolerance.

Step 3: Be open to learning and evolving your investment strategy based on mentorship.

The final step is to embrace the wisdom your mentor shares with you. This doesn’t mean following their advice blindly, but rather integrating their insights with your own research and analysis. My experience on the farm, where I learned from my family the value of hard work and adaptability, showed me that success comes from listening, learning, and applying those lessons to your own context. Your mentor’s experiences, both their successes and failures, are a treasure trove of knowledge. By being receptive and adaptable, you can avoid common pitfalls and refine your investment strategy for better outcomes.

By acknowledging the value of a mentor, seeking the right guide, and integrating their wisdom into your investment approach, you’re setting yourself up for a more informed and potentially more successful investing journey.

Remember, the path to investment success is not a solo expedition but a journey enriched by the experiences and guidance of those who have navigated it before you.

The power of mentorship to accelerate your investment career

by Yolanda Beattie

Despite growing efforts to address the gender imbalance across investment management, breaking into this traditionally male-dominated field can be challenging for women. Whether it’s a need for more awareness about the industry or a lack of confidence in their abilities, women apply for and secure far fewer investing roles than their male peers. With investment teams also small with low turnover, competition for roles is intense, and opportunities often arise through existing relationships, that is, “who you know”.

So, how can women get a leg up in this industry? Find yourself a mentor!

Why mentorship matters

Mentorship can be a game-changer if you aspire to a career in investment management. Mentors offer guidance and support, drawing from their own experiences to help you understand the industry, define your career goals and navigate challenges. They can open doors to networking opportunities, connecting you with industry insiders and potential job prospects. Mentors can also provide feedback on any skills gaps and help you develop essential capabilities like financial analysis and effective communication, boosting your confidence and resilience along the way.

Finding a mentor

When seeking a mentor, consider people in your existing network that you admire and respect or professional investors you have met or were inspired by at networking events. Be brave and contact them on LinkedIn to express your interest in a meeting and potential mentoring relationship. Highlight your goals and aspirations, and pique their interest with an interesting investing idea, left-field stock pick or investment thesis you’d like to discuss.

Getting the most out of mentorship

When embarking on a mentoring relationship, start with getting to know each other, sharing your experiences and building rapport. Clearly define your goals and expectations upfront, and make a solid commitment to each other to show up, come prepared, and follow through. Being receptive to feedback and maintaining open communication is critical to fostering a positive and collaborative relationship. And remember, mentorship is a two-way street, mentors get as much out of these relationships as mentees.

The Canvas Of Wealth: Navigating The Evolving Landscape Of Art Investment In 2024

By

In an era of economic uncertainty and market volatility, high-net-worth individuals (HNWIs) are increasingly turning their attention to alternative investments. Among these, the art market stands out as a compelling option, offering not just potential financial returns but also the allure of owning pieces of cultural significance. However, as we delve into 2024, the landscape of art investment is undergoing significant shifts, presenting both challenges and opportunities for savvy investors.

The State of the Market: A Delicate Balance

According to the latest UBS and Art Basel Art Market Report, the global art market experienced a slight contraction in 2023, with sales dipping 4% year-on-year to an estimated $65 billion. This decline, following two years of growth, reflects the impact of high interest rates, inflation, and political instability on the market. Yet, it’s crucial to note that despite this downturn, the market remains resilient, with values still above the pre-pandemic level of $64.4 billion in 2019.

Interestingly, while overall value decreased, the volume of transactions increased by 4% to 39.4 million in 2023. This trend suggests a shift in market dynamics, with more activity at lower price points and a pullback in the high-end segment. For investors, this presents a nuanced picture: while blockbuster sales may be less frequent, there’s increased liquidity and opportunity in the broader market.

Geographic Shifts: New Centers of Gravity

The art market’s geographic landscape is evolving, offering new avenues for diversification. While the United States maintains its position as the global leader, accounting for 42% of the market by value, its dominance showed signs of weakening with a 3% year-on-year decline.

China, including Mainland China and Hong Kong, has emerged as a formidable player, increasing its market share to 19% and growing by 9% to an estimated $12.2 billion in 2023. This shift is particularly noteworthy for investors looking to diversify their art portfolios geographically.

The United Kingdom, traditionally a strong player, fell to third place with a 17% market share, while France maintained its fourth position with a 7% share. These changes in the global art landscape underscore the importance of a geographically diversified approach to art investment.

The Digital Revolution: Online Sales and NFTs

One of the most significant trends reshaping the art investment landscape is the continued growth of online sales. Despite the overall market downturn, online sales increased by 7% to an estimated $11.8 billion in 2023. This figure, while down from the peak of $13.3 billion in 2021, remains almost double the pre-pandemic level and now accounts for 18% of the market’s total turnover.

The online market presents unique opportunities for investors, particularly in the lower to mid-price ranges. Data from the fine art auction sector in 2023 showed that 58% of the value in online-only auctions came from sales under $50,000, with over 85% from works sold for less than $250,000. This trend suggests that online platforms are democratizing art investments, allowing for more diverse portfolio-building strategies.

However, the NFT (non-fungible token) market, which captured significant attention in recent years, has shown signs of cooling. Sales of art-related NFTs on platforms outside the traditional art market declined for the second consecutive year, reaching $1.2 billion in 2023 – a 51% year-on-year drop. While this figure still represents a market 60 times larger than in 2020, it indicates that the NFT space remains volatile and requires cautious consideration from investors.

Emerging Trends: Prints, Multiples, and Market Bifurcation

Looking ahead, several trends are shaping the art investment landscape in 2024 and beyond. The prints and multiples market is set for continued growth, building on its impressive 18% increase in sales from 2023. This segment offers accessibility and affordability, potentially attracting a broader range of collectors and investors.

Another notable trend is the growing divide between established and emerging segments of the market. According to MyArtBroker, blue-chip artists and the secondary market are poised for continued strength and stability, while the primary market, art fairs, and ultra-contemporary artists face an uncertain future. This bifurcation presents both opportunities and risks for investors, depending on their risk appetite and investment goals.

Investment Strategies for the Discerning Collector

Given the complex and evolving nature of the art market, HNWIs should consider the following strategies when approaching art investment:

1. Diversification is Key: The divergent performance of different geographic markets and market segments underscores the importance of a diversified art portfolio. Consider balancing investments across regions, mediums, and price points.

2. Focus on Quality and Provenance: With a contraction in the high-end market, there may be opportunities to acquire blue-chip artworks at more favorable prices. However, thorough due diligence and expert advice remain crucial. Focus on works with strong provenance and established market histories.

3. Embrace Digital Platforms: The continued growth of online sales presents opportunities for acquiring art at various price points. Platforms like Artsy, Saatchi Art, and Artfinder offer access to a wide range of artworks and can be particularly useful for building a diverse collection or for those new to art investing.

4. Consider Fractional Ownership: As the market for high-end artworks becomes more challenging, explore opportunities in fractional ownership platforms. Companies like Masterworks allow investors to buy shares in high-value artworks, providing access to blue-chip pieces at lower entry points.

5. Stay Informed and Attend Key Events: Keep abreast of market trends, emerging artists, and technological developments in the art world. Attend major art fairs like Art Basel, Frieze Art Fair, and The Armory Show to discover new talent and stay connected with the pulse of the market.

6. Explore Alternative Investment Platforms: Platforms like Yieldstreet offer asset-backed art investments, providing alternative ways to gain exposure to the art market without direct ownership of artworks.

7. Be Cautious with NFTs:While the NFT market remains significant, its volatility requires a cautious approach. Consider allocating only a small portion of your art investment portfolio to this segment, if at all.

8. Seek Expert Advice: Given the complexities of the current market, working with reputable art advisors, gallerists, and auction houses is more important than ever to make informed investment decisions.

The Future of Art Investment: Challenges and Opportunities

As we look to the future, several factors are likely to shape the art investment landscape:

1. Technological Integration: Expect significant advancements in digital tools for valuation, authentication, and portfolio management. This tech revolution will enhance transparency in the market and potentially attract more tech-savvy investors to the art world.

2. Shift Towards Private Sales: As public auctions face challenges, particularly with single-owner collections, there will likely be a noticeable shift towards private transactions. This trend could reshape how high-value artworks change hands in the future.

3. Sustainability and Ethical Considerations: As environmental and social concerns become increasingly important to investors, expect to see a growing focus on sustainable practices in art production, transportation, and exhibition.

4. Emerging Markets: Keep an eye on emerging art markets in Asia, Africa, and Latin America, which may offer new opportunities for diversification and potential high returns.

5. Regulatory Changes: As the art market becomes more financialized, it may face increased regulatory scrutiny. Stay informed about potential changes in tax laws, anti-money laundering regulations, and other legal considerations that could impact art investments.

Platforms and fairs for art investing

Over the past five years, art dealers have significantly increased their use of online channels for transactions, driven by advancements in online viewing rooms and imaging technology. The COVID-19 pandemic notably boosted online sales from 13% in 2019 to 39% in 2020. As live events resumed, this share decreased but remained higher than pre-pandemic levels, stabilizing at 23% in 2023.

Dealers’ own online-only sales saw the most significant growth, doubling in share since 2019 and accounting for 20% of total sales in 2023. In contrast, sales through online art fairs and third-party platforms remained minimal. High Net Worth (HNW) collectors showed a strong preference for purchasing through dealers’ websites, though a majority still preferred in-person transactions.

The proportion of online sales to new buyers, who had never visited the gallery in person, fluctuated, indicating challenges in converting these buyers into regular clients. Larger galleries saw a higher share of regular online buyers, while smaller galleries experienced mixed success with new clients.

Despite the growth in e-commerce, dealers continued to face challenges, including political and economic instability, which affected demand. Many dealers had to offer higher discounts to close sales in 2023. Looking ahead, nearly half of the dealers expect online sales to grow in 2024, highlighting the ongoing importance of digital strategies in the art market.

Below are the most popular online platforms and offline events for exploring art investing:

1.Masterworks:

- Description: Masterworks allows investors to buy shares in high-value artworks. The platform purchases paintings and then offers shares to investors, who can benefit from the appreciation of the artwork’s value over time.

- Website: Masterworks

2.Artsy:

- Description: Artsy is an online platform that connects collectors with galleries and artists. It offers a wide range of artworks for purchase, allowing investors to buy pieces directly from the platform.

- Website: Artsy

3. Art Investment Platform (AIP):

- Description: AIP provides a marketplace for investing in contemporary art. They offer a range of services including art advisory and portfolio management.

- Website: Art Investment Platform

4. Saatchi Art:

- Description: Saatchi Art is an online gallery that allows collectors to purchase original artwork and prints directly from artists around the world. It offers a wide selection of contemporary art.

- Website: Saatchi Art

5. Yieldstreet:

- Description: Yieldstreet is an alternative investment platform that includes art among its offerings. Investors can participate in asset-backed art investments with the potential for attractive returns.

- Website: Yieldstreet

6.Maecenas:

- Description: Maecenas is a blockchain-based platform that allows investors to buy fractional ownership in high-value artworks. It leverages blockchain technology to ensure transparency and security.

- Website: Maecenas

7.Artfinder:

- Description: Artfinder is an online marketplace where collectors can buy original art directly from independent artists. It features a diverse range of artworks, from paintings to sculptures.

- Website: Artfinder

8.Rarity:

- Description: Rarity is a platform that specializes in rare and limited-edition artworks. Investors can buy and trade rare art pieces, with a focus on high-value and collectible items.

- Website: Rarity

Finding new and promising artists who may be good investment opportunities often involves attending key art events and exhibitions. Here are some of the best events and exhibitions for discovering emerging talent:

1.Major Art FairsArt Basel (Switzerland, Miami, Hong Kong)

- Renowned for showcasing contemporary art from leading galleries worldwide. It’s a premier event for discovering both established and emerging artists.

- Art Basel

2.Frieze Art Fair (London, New York, Los Angeles)

- Focuses on contemporary art and features a mix of established and emerging artists. It includes Frieze Masters, which showcases historical art.

- Frieze

3.The Armory Show (New York)

- A leading international art fair showcasing important 20th- and 21st-century artworks, with a strong emphasis on new artists.

- The Armory Show

4.Art Brussels (Belgium)

- Known for its focus on discovery, it offers a platform for both established and emerging artists, with a strong emphasis on the latter.

- Art Brussels

5.Venice Biennale (Italy)

- One of the most prestigious cultural events, featuring contemporary artists from around the world. It’s a key venue for discovering new talent.

- Venice Biennale

Venice Biennale 2024: experience and its implications for art investors

Attending the Venice Biennale can be an overwhelming experience for aspiring art investors. The event spans kilometres of beautiful and thought-provoking art, but it’s incredibly time-consuming and often the most engaging pavilions don’t necessarily align with the best investment opportunities. For instance, one of the most popular and fun exhibits; Serbian pavilion’s “Exposition coloniale” offers a profound exploration of colonialism’s lasting impact, challenging viewers to reexamine power dynamics and societal anxieties. Visitors would spend around 20 mins enjoying the immersive and sensory stimulating time machine that pushes you into the early 90s. Similarly, Zimbabwe’s pavilion presents a visually striking and conceptually rich exhibition centred around the concept of “kududunuka,” or unravelling, which pushes boundaries of time, identity, and nationhood in a sustainable way. While these exhibitions are incredibly intellectually stimulating and culturally significant, they may not translate directly into lucrative investments. The sheer volume of stimuli at the Biennale can be daunting for newcomers to the art investment world. As such, alternative approaches like fractional ownership or online sales platforms may offer a less immersive but more accessible entry point into art investing, allowing individuals to gradually build their knowledge and confidence without the sensory overload of major international exhibitions.

Conclusion: The Art of Long-Term Thinking

Investing in art requires a delicate balance of passion and pragmatism. While the market may face headwinds in the short term, the long-term prospects for art as an investment remain strong. As with any investment, a well-informed, diversified, and patient approach is likely to yield the best results.

For HNWIs looking to combine cultural appreciation with portfolio diversification, the art market in 2024 offers a canvas rich with potential. By staying attuned to market trends, embracing technological innovations, and focusing on quality and long-term value, investors can navigate the challenges of today’s art market and potentially reap significant rewards in the future.

As we move forward, it’s clear that the art market will continue to evolve, influenced by global economic trends, technological advancements, and shifting cultural values. Those who approach art investment with a blend of passion, knowledge, and strategic thinking will be best positioned to succeed in this dynamic and fascinating market.

In the end, investing in art is not just about financial returns; it’s about participating in the ongoing dialogue of human creativity and cultural expression. As you consider adding art to your investment portfolio, remember that beyond the potential for financial gain, you’re also acquiring a piece of history, culture, and human ingenuity. It’s this dual nature of art as both an asset and a cultural artifact that makes it a uniquely rewarding investment for those willing to navigate its complex landscape.

10 Day Trading Tips and How To Get Started

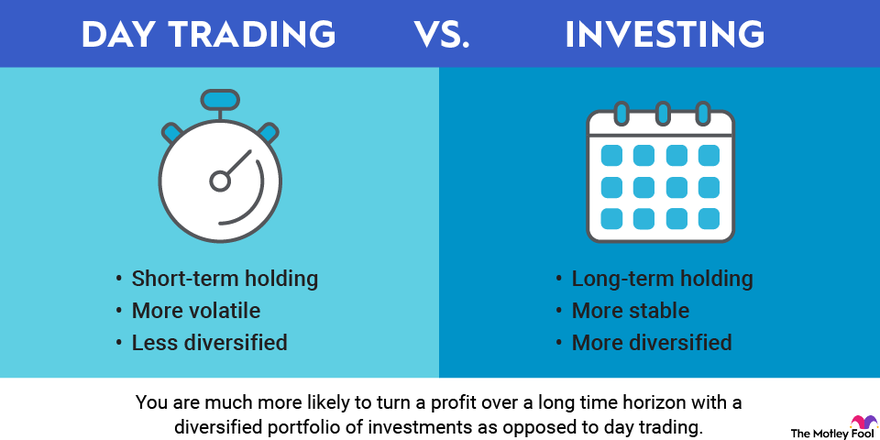

Day trading is a strategy that involves buying and selling financial instruments at least once within the same day, attempting to profit from small price fluctuations. This approach can be lucrative, but it can also be risky if undertaken without a thoughtful strategy.

The best day trading platforms help traders improve their strategies and minimize their costs, offering apps that make it easy to analyze indicators and execute trades. Interactive Brokers and Webull, for example, offer real-time streaming quotes, charting tools, and the ability to enter and modify complex orders in quick succession.

But for those who are just beginning their day trading journey, this article will explain the key steps to getting started and explore 10-day trading tips for beginners—from setting aside funds and starting small to avoiding penny stocks and limiting losses.

Key Takeaways

- Day trading is only profitable in the long run when traders take it seriously and do their research.

- Day traders must be diligent, focused, objective, and unemotional in their work.

- Interactive Brokers and Webull are two recommended online brokers for day traders.

- Day traders often look at liquidity, volatility, and volume when deciding what stocks to buy.

- Some tools that day traders use to pinpoint buying points include candlestick chart patterns, trend lines and triangles, and volume.

How To Start Day Trading

Getting underway in day trading involves putting your financial resources together, setting up with a broker who can handle day trading volume, and engaging in self-education and strategic planning. Here’s how to start in five steps:

Step 1: Research trading strategies and principles.

Unlike professional day traders, retail day traders don’t necessarily need a special undergraduate degree. However, you still need to educate yourself. Before you start trading, it’s crucial to understand the trading principles and specific strategies used in day trading. Read books, take courses, and study financial markets. The major topic to study is technical analysis, which should include reading up on trading psychology and (this is a must) risk management.

Step 2: Develop your trading plan.

Outline your investment goals, risk tolerance, and specific trading strategies you’ve picked up from Step 1. Your plan should specify your entry and exit criteria, how much capital you will risk on each trade, and your overall risk management strategy. Before investing real money, put your plan into practice with a real-time trading simulator. This helps you familiarize yourself with market behavior and the trading platform without financial risk.

Step 3: Choose a trading platform and fund your account.

You’ll want a reputable broker that caters to day traders and has low transaction fees, quick order execution, and a reliable trading platform. Once you’re ready, fund your account. It’s advisable to begin with a relatively small amount in your trading account and only put in money you can afford to lose.

Step 4: Begin trading with small positions.

This reduces the risks of losing all your money on one or a series of bad trades while you’re still learning. As you do so, continuously review your trades and check them against your learning resources to adjust your strategy. Day trading requires constantly adapting to changing situations.

Step 5: Maintain discipline.

Adjusting to changing circumstances does not mean shifting your stop-loss and stop-limit settings or other trading criteria as you take on more risk. Successful day trading relies very much on discipline and emotional control. Stick to your trading plan; don’t let emotions drive your decisions. That’s the way to quick ruin.

10 Day Trading Tips for Beginners

1. Knowledge Is Power

In addition to knowledge of procedures, day traders need to keep up with the latest stock market news and events that affect stocks. This included the Federal Reserve System’s interest rate plans, leading indicator announcements, and other economic, business, and financial news.

So, do your homework. Make a wish list of stocks you’d like to trade. Be informed about the selected companies, their stocks, and general markets. Scan business news and bookmark reliable online news outlets.

2. Set Aside Funds

Assess and commit to the amount of capital you’re willing to risk on each trade. Many successful day traders risk less than 1% to 2% of their accounts per trade. If you have a $40,000 trading account and are willing to risk 0.5% of your capital on each trade, your maximum loss per trade is $200 (0.5% x $40,000). Moreover, only trade with suitable online brokers and trading platforms.

Earmark funds you can trade with and are prepared to lose.

3. Set Aside Time

Day trading requires your time and attention. In fact, you’ll need to give up most of your day. Don’t consider it if you have limited time to spare.

Day trading requires a trader to track the markets and spot opportunities that can arise at any time during trading hours. Being aware and moving quickly are key.

4. Start Small

As a beginner, focus on a maximum of one to two stocks during a session. Tracking and finding prospects is easier with just a few stocks. It’s now common to trade fractional shares. That lets you specify smaller dollar amounts that you wish to invest.

This means that if Amazon.com (AMZN) shares are trading at $170, many brokers will now let you buy a fractional share for as low as $5.

5. Avoid Penny Stocks

You’re probably looking for deals and low prices but stay away from penny stocks. These stocks are often illiquid and the chances of hitting the jackpot with them are often bleak.

Many stocks trading under $5 a share become delisted from major stock exchanges and are only tradable over-the-counter (OTC). Unless you see a real opportunity and have done your research, steer clear of these. Finding real undervalued stocks can be demanding.

6. Time Those Trades

Many orders placed by investors and traders begin to execute as soon as the markets open in the morning, contributing to price volatility. A seasoned player may be able to recognize patterns at the open and time orders to make profits. For beginners, it may be better to read the market without making any moves for the first 15 to 20 minutes.

The middle hours are usually less volatile. Then, the movement begins to pick up again toward the closing bell. Though rush hours offer opportunities, it’s safer for beginners to avoid them at first.

7. Cut Losses With Limit Orders

Decide what type of orders you’ll use to enter and exit trades. Will you use market orders or limit orders? A market order is executed at the best price available, with no price guarantee. It’s useful when you want to enter or exit the market and don’t care about getting filled at a specific price.

A limit order guarantees the price but not the execution.2 Limit orders can help you trade more precisely and confidently because you set the price at which your order should be executed. A limit order can cut your loss on reversals. However, if the market doesn’t reach your price, your order won’t be filled and you’ll maintain your position.

More sophisticated and experienced day traders may also employ options strategies to hedge their positions.

8. Be Realistic About Profits

A strategy doesn’t need to succeed all the time to be profitable. Traders can be successful by only profiting from 50% to 60% of their trades. However, they need to profit more on their winners than they lose on their losers. Ensure the financial risk on each trade is limited to a specific percentage of your account and that entry and exit methods are clearly defined.

9. Reflect on Investment Behavior

For day traders, frequent reflection on investment behavior is crucial. It helps them identify patterns, learn from past mistakes, and fine-tune their strategies. This fosters continuous learning and adapting to ever-changing market conditions. In addition, it encourages discipline and emotional control, which are key to successful trading.

10. Stick to the Plan

Successful traders have to move fast, but they don’t have to think fast. Why? Because they’ve developed a trading strategy in advance, along with the discipline to stick to it. It is important to follow your formula and methodology closely rather than try to chase profits. Don’t let your emotions get the best of you and make you abandon your strategy. Bear in mind a mantra of day traders: plan your trade and trade your plan.

What Makes Day Trading Difficult?

Day trading takes a lot of practice and know-how, and several factors can make it challenging.

First, know that you’re competing against professionals whose careers revolve around trading. These people have access to the best technology and connections in the industry, which means they’re set up to succeed. Jumping on the bandwagon usually means more profits for them.

Next, understand that Uncle Sam will want a cut of your profits, no matter how slim. You’ll have to pay taxes on any short-term gains—investments you hold for one year or less—at the marginal rate. The upside is that your losses will offset any gains.3

Also, as a beginning day trader, you may be prone to emotional and psychological biases that affect your trading—for instance, when your capital is involved and you’re losing money on a trade. Experienced, skilled professional traders with deep pockets can usually surmount these challenges.

An early popularizer of day trading, Toby Crabel, is also credited with a classic day trading strategy, the opening range breakout. Crabel has had some influence on technical analysis, and he often suggested that day traders are social psychologists with a computer program.4

Deciding What and When To Buy

What To Buy

Day traders try to make money by exploiting minute price movements in individual assets (stocks, currencies, futures, and options). They usually leverage large amounts of capital to do so. In deciding what to buy—a stock, say—a typical day trader looks for three things:

- Liquidity. A security with this allows you to buy and sell it easily and, hopefully, at a reasonable price. Liquidity is an advantage with tight spreads, or the difference between the bid and ask price of a stock, and for low slippage, or the difference between the expected price of a trade and the actual price.

- Volatility. This measures the daily price range—the range in which a day trader operates. More volatility means greater potential for profit or loss.

- Trading volume measures the number of times a stock is bought and sold in a given period. It’s commonly known as the average daily trading volume. High volume indicates a lot of interest in a stock. An increase in a stock’s volume is often a harbinger of a price jump, either up or down.

When To Buy

Once you know the stocks (or other assets) you want to trade, you need to identify entry points for your trades. Tools that can help you do this include:

- Real-time news services: News moves stocks, so it’s important to subscribe to services that alert you when potentially market-moving news breaks.

- ECN/Level 2 quotes: Electronic communication networks (ECNs) are computer-based systems that display the best available bid and ask quotes from market participants and then automatically match and execute orders. Level 2 is a subscription-based service that provides real-time access to the Nasdaq order book, which has price quotes from market makers in every Nasdaq-listed and OTC Bulletin Board security.5 Together, they can give you a sense of orders executed in real-time.

- Intraday candlestick charts: Candlesticks provide a raw analysis of price action. More on these later.

Define and write down the specific conditions under which you’ll enter a position. For instance, buying during an uptrend isn’t specific enough. Instead, put down something more specific and testable: buy when the price breaks above the upper trendline of a triangle pattern, where the triangle is preceded by an uptrend (at least one higher swing high and higher swing low before the triangle formed) on the two-minute chart in the first two hours of the trading day.

Once you have specific entry rules, scan more charts to see if your conditions are generated each day. For instance, determine whether a candlestick chart pattern signals price moves in the direction you anticipate. If so, you have a potential entry point for a strategy.

Next, you’ll need to determine how to exit your trades.

Deciding When To Sell

There are several ways to exit a winning position, including trailing stops and profit targets. Profit targets are the most common exit method. They refer to taking a profit at a predetermined price level. Here are some common profit target strategies:

| Strategy | Description |

|---|---|

| Scalping | Scalping is one of the most popular strategies. It involves selling almost immediately after a trade becomes profitable. The price target is whatever figure means that you’ll make money on the trade. |

| Fading | Fading involves shorting stocks after rapid moves upward. This is based on the assumption that (1) they are overbought, (2) early buyers are ready to take profits, and, (3) existing buyers may be scared away. Although risky, this strategy can be extremely rewarding. Here, the price target is when buyers begin stepping in again. |

| Daily Pivots | This strategy involves profiting from a stock’s daily volatility. You attempt to buy at the low of the day and sell at the high of the day. Here, the price target is simply at the next sign of a reversal. |

| Momentum | This strategy usually involves trading on news releases or finding strong trending moves supported by high volume. One type of momentum trader will buy on news releases and ride a trend until it exhibits signs of reversal. Another type will fade the price surge. Here, the price target is when volume begins to decrease. |

Often, you will want to sell an asset when there is decreased interest in the stock as indicated by the ECN/Level 2 and volume. The profit target should also allow for more money to be made on winning trades than is lost on losing trades. If your stop loss is $0.05 away from your entry price, your target should be more than $0.05 away.

Just as with your entry point, define exactly how you will exit your trades before you enter them. The exit criteria must be specific enough to be repeatable and testable.

Day Trading Charts and Patterns

Here are three common tools day traders use to help them determine opportune buying points:

- Price charts using depictions such as candlesticks. Also, various chart patterns, including engulfing candles, dojis, and many others.

- Other technical analysis, including trend lines and various indicators such as the relative strength index, moving average convergence divergence, and many others.

- Volume

There are many candlestick setups a day trader can look for to find an entry point. If followed correctly, the doji reversal pattern (highlighted in yellow in the chart below) is one of the most reliable.

:max_bytes(150000):strip_icc()/DayTradingChartsandPatterns22-1713356e5c8c447691593574eebd9e60.png)

Also, look for signs that confirm the pattern:

- A volume spike on the doji candle or the candles immediately following it, which can indicate that traders are supporting the price at this level

- Prior support at this price level, such as the prior low of day or high of day Level 2 activity, which will show all the open orders and order sizes

If you use these three confirmation steps, you may determine whether the doji is signaling an actual turnaround and a potential entry point.

Chart patterns also provide profit targets for exits. For example, the height of a triangle at the widest part is added to the breakout point of the triangle (for an upside breakout), providing a price at which to take profits.6

How To Limit Losses When Day Trading

Stop-Loss Orders

It’s important to define exactly how you’ll limit your trade risk. A stop-loss order is designed to limit losses on a position in a security.7 For long positions, a stop-loss can be placed below a recent low and for short positions, above a recent high. It can also be based on volatility.

For example, if a stock price is moving about $0.05 a minute, then you might place a stop-loss order $0.15 away from your entry to give the price some space to fluctuate before it moves in your anticipated direction.

For a triangle pattern, a stop-loss order can be placed $0.02 below a recent swing low if buying a breakout, or $0.02 below the pattern.

You could also set two stop-loss orders:

- Place an actual stop-loss order at a price level that suits your risk tolerance. This level represents the most money that you can stand to lose.

- Set a mental stop-loss order at the point where your entry criteria would be violated. If the trade takes an unexpected turn, you’ll immediately exit your position.

However you decide to exit your trades, the exit criteria must be specific enough to be testable and repeatable.8

Set a Financial Loss Limit

It’s smart to set a maximum loss per day that you can afford. Whenever you hit this point, exit your trade and take the rest of the day off. Stick to your plan. After all, tomorrow is another (trading) day.

Test Your Strategy

You’ve defined how you enter trades and where you’ll place a stop-loss order. Now, you can assess whether the potential strategy fits within your risk limit. If the strategy exposes you to too much risk, you need to alter it in some way to reduce the risk.

If the strategy is within your risk limit, then testing begins. Manually go through historical charts to find entry points that match yours. Note whether your stop-loss order or price target would have been hit. Paper trade in this way for at least 50 to 100 trades. Determine whether the strategy would have been profitable and if the results meet your expectations.

If your strategy works, proceed to trading in a demo account in real time. If you take profits over the course of two months or more in a simulated environment, proceed with day trading with real capital. If the strategy isn’t profitable, start over.

Finally, keep in mind that if you trade on margin, you can be far more vulnerable to sudden price movements. Trading on margin means borrowing your investment funds from a brokerage firm. It requires you to add funds to your account at the end of the day if your trade goes against you. Therefore, using stop-loss orders is crucial when day trading on margin.9

Day Trading Strategies for Beginners

Now that you know some of the ins and outs of day trading, let’s review some of the key techniques new day traders can use.

When you’ve mastered these techniques, developed your own trading styles, and determined your end goals, you can use a series of strategies to help you in your quest for profits.

Although some of these techniques were mentioned above, they are worth going into again:

- Following the trend: Anyone who follows the trend will buy when prices are rising or short sell when they drop. This is done on the assumption that prices that have been rising or falling steadily will continue to do so.

- Contrarian investing: This strategy assumes a rise in prices will reverse and drop. The contrarian buys during a fall or short sells during a rise, with the express expectation that the trend will change.

- Scalping: This is a style by which a speculator exploits small price gaps created by the bid-ask spread. This technique normally involves entering and exiting a position quickly—within minutes or even seconds.

- Trading the news: Investors using this strategy will buy when good news is announced or short sell when there’s bad news. This can lead to greater volatility, which can lead to higher profits or losses.

Why Is It Difficult To Make Money Consistently From Day Trading?

Doing so requires combining many skills and attributes—knowledge, experience, discipline, mental fortitude, and trading acumen.

It’s not always easy for beginners to carry out basic strategies like cutting losses or letting profits run. What’s more, it’s difficult to stick to one’s trading discipline in the face of challenges such as market volatility or significant losses.

Finally, day trading means going against millions of market participants, including trading pros who have access to cutting-edge technology, a wealth of experience and expertise, and very deep pockets. That’s no easy task when everyone is trying to exploit inefficiencies in the markets.

Should a Day Trading Position Be Held Overnight?

A day trader may wish to hold a trading position overnight either to reduce losses on a poor trade or to increase profits on a winning trade. Generally, this is not a good idea if the trader simply wants to avoid booking a loss on a bad trade.

Risks involved in holding a day trading position overnight may include having to meet margin requirements, additional borrowing costs, and the potential impact of negative news. The risk involved in holding a position overnight could outweigh the possibility of a favorable outcome.

How Much Do Day Traders Make?

Day traders’ earnings vary widely based on experience, skill level, trading strategy, and market conditions. Some may earn a substantial income, while others may not be as successful. It’s important to note that day trading involves significant risk and is not suitable for everyone.

Is Day Trading Worth It?

This largely depends on individual circumstances, risk tolerance, and expertise. While it can offer significant profits and flexibility for some, it’s high-risk, time-consuming, and not suitable for everyone. It’s estimated that a majority of day traders don’t profit, indicating the need for careful consideration and preparation.

How Much Money Do I Need To Start Day Trading Stocks?

The Financial Industry Regulatory Authority’s (FINRA) pattern day trader rule requires a $25,000 minimum balance if you want to make four or more day trades within a five-business day span.10 Beyond that, consider transaction costs (commissions, fees) that will eat into your profits and the need for a financial cushion to handle potential losses—the FINRA rule is meant to be a minimum. It’s prudent to have significantly more capital to trade effectively and, frankly, reduce the psychological pressure of trading with money you can’t afford to lose. Day trading is highly risky, and most individual traders don’t achieve success.11 It should be approached with the understanding that it takes significant skill and a high tolerance for risk. Day trading is not the path to quick or easy profits.

The Bottom Line

Day trading is difficult to master. It requires time, skill, and discipline. Many who try it lose money, but the strategies and techniques described above may help you create a potentially profitable strategy.

Day traders, both institutional and individual, play an important role in the marketplace by keeping the markets efficient and liquid. With enough experience, skill-building, and consistent performance evaluation, you may be able to beat the odds and improve your chances of trading profitably.

72 stock market terms every beginner trader should know

By Team Stash

Learning to navigate the stock market as a new investor can be intimidating, but getting familiar with basic stock market terms can get you up and running sooner than you’d think.

Understanding stock market fundamentals is key to making smart investing decisions, keeping a pulse on the market, and eventually taking on more complex trading strategies. Use the terms below to get a jump start on learning basic stock market vocabulary and create a strong foundation for your long-term wealth goals.

What is the stock market?

The stock market is a collection of markets where people buy and sell shares of publicly traded companies. When someone invests in a stock, their investment is represented by a share, or partial ownership, of that company.

The stock market operates by potential buyers naming the highest price they’ll pay for an asset (the “bid”) and potential sellers naming the lowest price they’re willing to sell for (the “ask”). Trades are typically executed by stockbrokers on behalf of individual investors.

72 stock market terms for new investors

The stock market terms below are a great starting point if you’re new to trading stocks. Study these terms to familiarize yourself with common stock lingo that any new investor should understand.

1. Arbitrage

Arbitrage refers to purchasing an asset from one market and selling it to another market where the selling price is higher than what you paid for it, resulting in profit.

2. Ask

An ask is the selling price that a trader offers for their shares.

3. Asset Allocation

Asset allocation is an investment strategy that aims to balance risk and reward by dividing a certain percentage of investments—like stocks, bonds, real estate, cash, etc.—across different assets in an investment portfolio.

4. Asset Classes

Asset classes are categories of assets, such as stocks, bonds, real estate, or cash.

5. Averaging Down

Averaging down is an investing strategy that involves buying additional shares of an asset or stock after its price has fallen, resulting in a lower average purchase price.

6. Bear Market

A bear market is a market condition in which prices are expected to fall. Typically, this entails major indexes or stocks decreasing by 20% or more compared to previous highs.

7. Beta

Beta is the measure of an asset’s risk in relation to the market. A stock with a beta of 1.5 means that the stock typically moves 50% more than the market in the same direction. Generally, a higher beta indicates a riskier investment—if the market rises 10%, the stock will rise by 15%, but if the market falls by 10%, the stock will fall by 15%.

8. Bid

The price a trader is willing to pay for shares of a stock or other asset.

9. Bid-Ask Spread

Bid-ask spread is the difference between what buyers are willing to pay and the price sellers are asking for a stock.

10. Blockchain

A blockchain is a record-keeping database in which transactions made in Bitcoin or other cryptocurrencies are recorded across multiple computers and distributed across the entire network of those computers.

11. Blue-Chip Stocks

Blue-chip stocks are common stocks of well-known companies known for their quality and history of growth.

12. Bond

A bond is a type of security loaned by an investor to a borrower like a company or government used to fund its operations.

13. Bull Market

A bull market is a market condition in which prices are expected to rise.

14. Buyback

A buyback is when a company repurchases outstanding shares to reduce the number of shares on the market and return profits to their investors, resulting in an increased value of the remaining shares.

15. Capitalization

Also known as market cap, capitalization is the total market value of all a company’s outstanding shares. It’s calculated by multiplying the total number of shares by the current share price. Check out the largest companies by market cap here.

16. Capital Gains

Capital gains refers to the profit earned after selling an asset or investment for a higher price than you paid for it.

17. Common Stock

This is one of the most basic stock market terms to know. Common stock is a type of security that represents ownership in a company. Holders of common stock are able to vote on matters like corporate policies and elect directors within that company.

18. Current Ratio

The current ratio is a measure of a company’s ability to pay short-term debt. It’s determined by dividing current assets by current liabilities.

19. Day Trading

Day trading is the practice of buying and selling shares of stock within a single day.

20. Debt-to-Equity Ratio

Debt-to-equity ratio represents a function of a company’s debt relative to its equity, or the value of its assets minus its liabilities. The ratio is found by dividing total liabilities by total shareholder equity.

21. Diversification

Diversification is an investment strategy that divides investment funds across a variety of assets in order to minimize overall risk.

22. Dividend

“Dividend” is one of the most basic terms for the stock market. It’s simply a portion of a company’s earnings paid out to its shareholders.

23. Dividend Yield

A dividend yield is a dividend expressed as a percentage of its stock price.

24. Dollar-Cost Averaging

Dollar-cost averaging is an investment strategy in which you invest a fixed amount on a regular basis regardless of the price of the asset.

25. Dow Jones Industrial Average (DJIA)

Also known as Dow 30, the Dow Jones Industrial Average is a stock market index consisting of the 30 most-traded blue-chip stocks on the New York Stock Exchange. It’s used to measure the performance of shares among the largest U.S. companies and gauge the overall direction of stock prices.

26. Earnings per Share (EPS)

Earnings per share is a company’s profit divided by its number of outstanding shares, and is used to measure corporate profitability.

27. Economic Bubble

An economic bubble is a situation where asset prices surge to significantly higher levels than the fundamental value of that asset.

28. Equal Weight Rating

An equal weight rating is a measure used by equity analysts to signify how well a stock is performing relative to other stocks. An equal weight rating suggests that a stock will perform similarly with the average of all the stocks being used for comparison.

29. Equity Income

Equity income is used to describe any income received from stock dividends.

30. Exchange

An exchange, or stock exchange, is a marketplace where investors and traders buy and sell stocks. You’ve probably heard of the most well-known exchanges in the U.S.: the New York Stock Exchange (NYSE) and Nasdaq.

31. Exchange-Traded Funds (ETFs)

Commonly known as ETFs, exchange-traded funds are a collection of stocks or bonds combined in a single fund that can be purchased and traded on major stock exchanges. Similar to mutual funds, they’re a pooled investment fund, meaning a “pool” of money is aggregated from multiple investors.

32. Expense Ratio

An expense ratio measures the cost of owning a mutual fund, including expenses like the management of the fund, overhead fees, and any other costs associated with running the fund. It’s essentially an administrative fee paid to the company in return for owning the fund. The ratio is measured as a percentage of your total investment—for example, if you invest $10,000 in a fund with an expense ratio of .20%, you’ll pay $20 on top of your investment.

33. Futures

A future is a contract that requires a buyer to purchase a specific asset, and the seller to sell that asset at a certain future date at an agreed-upon price. Futures are a way for investors to hedge current investments—a risk management strategy intended to offset potential losses in other investments.

34. Going Long

Going long refers to the act of buying stock shares with the expectation that the asset’s price will rise, resulting in a profit.

35. Going Short

Going short—the opposite of going long—refers to the act of selling stock shares with the expectation that the asset’s price will fall. When an investor goes short on an asset, they borrow that asset, sell it, and hopefully purchase it later at a lower price if the price does decline, resulting in profit.

36. Growth and Income Funds

This is a type of mutual fund or ETF that has both a history of capital gains (growth) and income generated from dividends (income). Growth and income funds have a two-sided strategy of both long-term growth and short-term income.

37. Growth Stocks

A growth stockis a common stock of a company whose revenues are expected to grow at a significantly higher rate than what’s average for that industry.

38. Head and Shoulders Pattern

The head and shoulders pattern refers to a specific chart formation seen on a technical analysis chart. It appears when a stock price reaches three peaks: when the price peaks then declines; rises above that peak and declines again; and rises a third time (but not as high as the second peak) and then declines again. The second peak represents the formation’s “head,” and the first and third peaks represent the “shoulders.” It’s generally considered to be an indicator of an impending bear market.

39. Index Funds

Index funds are investment funds that follow the performance of a specific benchmark or stock market index, like the S&P 500. When you invest in an index fund, your money is used to invest in every company in that index. This results in a more diverse portfolio than if you were hand-selecting individual stocks, for example.

40. Inflation

Inflation is the rate of increase in prices for goods and services in the economy.

41. Initial Public Offering (IPO)

An IPO refers to a previously private company that becomes public by selling stock

shares on the stock market.

42. Limit Order

A limit order is an order to buy or sell a stock at or below a specific price. Limit orders give traders control over how much they pay.

43. Liquidity

Liquidity measures how quickly and easily a stock can be bought or sold without impacting its price. Cash, for example, is the most liquid asset—no exchange is necessary to gain value from it, and it’s already in its most liquid form. On the other hand, a car is less liquid—regardless of its value, you might have to wait to sell it at its best price.

44. Margin

Sometimes referred to as “buying on margin,” margin is when investors borrow money from a broker to purchase a stock, similar to a loan.

45. Market Index

A market index tracks the performance of a certain collection of stocks, often grouped to represent a certain industry. They’re a tool for investors to gauge the health of the stock market by comparing current and past stock prices.

46. Market Volatility

Market volatility is a measure of how much and how often the value of the stock market fluctuates.

47. Moving Average

A moving average is the average price of stocks or other assets over a specific period of time. Generally used in technical analysis charts, it’s calculated by averaging data from the previous time periods to help investors identify the current direction of price trends.

48. Mutual Funds

Mutual funds are pools of investments from shareholders used to “mutually” buy securities like stocks, bonds, and other assets.

49. Nasdaq

Nasdaq, or National Association of Securities Dealers Automated Quotations, is an electronic exchange where investors can buy and sell stocks through an automated network of computers. It’s the second-largest stock exchange in the world, following the NYSE.

More broadly, Nasdaq can also refer to the Nasdaq Composite Index, a stock market index of over 3,300 companies listed on the Nasdaq exchange. In this context, it can be thought of similarly to other indexes like the DJIA or the S&P 500.

50. Non-Fungible Token (NFT)

A non-fungible token, more commonly known as an NFT, is a blockchain-based financial security. Each NFT represents a unique digital asset. “Non-fungible” indicates that it can’t be replicated or replaced with something else.

51. Order Imbalance

An order imbalance occurs when orders of one type of stock aren’t offset by opposite orders, resulting in an excess of orders for that specific stock and sometimes volatile price changes.

52. OTC Stocks

OTC stocks, or over-the-counter stocks, are securities that are traded on a broker-dealer network instead of on a major U.S. stock exchange. They’re often used by smaller companies who don’t meet the requirements to be listed on a formal stock exchange.

53. Outstanding Shares

Outstanding shares refers to the total number of a company’s shares that have been issued to shareholders, including restricted shares.

54. P/E Ratio

Used to value a company, the P/E ratio, or price-earnings ratio, is the ratio of a company’s share price to the company’s earnings per share.

55. Preferred Stock

Preferred stock is a type of stock that combines characteristics of both common stock and bonds. Owners of preferred stock receive different rights than common stockholders, like receiving dividends before common stockholders, but they generally don’t come with corporate voting rights like common stocks do.

56. Price Quote

A price quote is the price of a stock or other security as quoted on an exchange. Price quotes usually come with important supplemental information to help traders make more informed investment decisions.

57. Profit Margin

Profit margins are used to gauge the profitability of a company. It’s expressed as a percentage and is calculated by dividing the company’s net profit (total revenue minus total expenses) by total revenue.

58. Recession

A recession is defined as a period of decline in economic performance throughout the economy, generally lasting for at least several months.

59. Risk Tolerance

Risk tolerance is a measure of the level of risk you’re willing to accept on your investments. Someone with a lower risk tolerance typically sees lower returns on their investments in exchange for lower overall risk in periods of market decline.

60. Roth IRA

A Roth IRA is an individual retirement account that allows you to contribute after-tax dollars, allowing your earnings to grow and be withdrawn tax-free.

61. Sector

The stock market includes shares from thousands of different companies, which are broken into 11 different sectors. A sector is a group of companies with similar business products, services, or characteristics.

62. Shares

Shares are units of ownership in part of a company’s total stock.

63. Stock Market Holidays

While this isn’t necessarily a term or definition, it’s important to know what days you can and can’t buy or sell on the U.S. stock exchange. The U.S. stock market observes 10 holidays a year, closing on those days. In 2024, the observed holidays are New Years Day, Martin Luther King Jr. Day, President’s Day, Good Friday, Memorial Day, Juneteenth National Independence Day, Independence Day, Labor Day, Thanksgiving, and Christmas.

64. Stock Option

A stock option is a contract that gives an investor the right to purchase or sell a specific number of stock shares at a predetermined price within a specified time period.

65. Stock Portfolio

A stock portfolio is an individual’s collection of investments, including stocks, bonds, mutual funds, and other financial assets. While a portfolio refers to all of your investments, they might not be contained in one single account.

66. Stock Split

A stock split occurs when a corporation increases the number of its outstanding shares by distributing more shares to current stockholders. By splitting existing shares into multiple new shares, the stock becomes more affordable.

67. Time Horizon

Time horizon refers to the period of time an investor expects to hold an investment, which will vary based on personal investment goals and strategies. For example, investing in a retirement account like a 401(k) has a longer time horizon, since the funds won’t be withdrawn until you reach retirement age. Generally speaking, longer time horizons correlate to more risk potential in a portfolio, and shorter time horizons correlate to a more conservative (less risky) portfolio.

68. Value Stocks

Value stocks are shares of companies selling at bargain prices that investors expect to rise because the company’s financial fundamentals suggest the shares are actually worth more than the current value.

69. Volume

Volume is a measure of how much a certain stock or other investment has been traded over a certain period of time. Volume is a critical component of strategically analyzing stock market trends, and is often used to determine market strength.

70. Volume-Weighted Average Price (VWAP)

Volume-weighted average price (VWAP) is a measure of the average trading price of a stock or other asset, adjusted for volume. It’s calculated by dividing the total dollar value of trading in that asset by the volume of trades.

71. Yield

Yield refers to the income earned on an investment over a set period of time, expressed as a percentage of your original investment.

72. 52-week Range

The 52-week range is a technical indicator that measures the lowest and highest price of a stock traded during a 52-week period. Traders use this measure to analyze current stock prices and predict its future movements.

Learning to navigate the stock market and stock trade terms for the first time might feel daunting, but consider this your official first step on the path to developing your investing muscles. When you come across a term you’re unfamiliar with in your own research, refer back to this post until you’ve mastered them. You’ll find that learning these stock terms for beginners is more doable than you think.

The more time you invest in learning stock market terms and fundamentals, the more confident you’ll become as an investor. And if you’re looking for a little more support, consider turning to a platform like Stash. We make it easy to invest what you can afford on a set schedule, all the while providing unlimited financial education and personalized advice based on your risk level—so you can start building long-term wealth, even if you’ve never invested before.

Warren Buffett’s investment advice: Top 10 tips for investing success

Written by James Royal Ph.D. Edited By Brian Beers

Warren Buffett is known as one of the best investors of all time, and he’s amassed more than a hundred-billion dollar fortune through his company Berkshire Hathaway. But he’s not only a great investor, he’s also a great wit, and Buffett enjoys sharing his folksy wisdom with fellow investors.

His advice runs the gamut of topics, not only about investing but about life in general. But today let’s stick to Buffett’s advice that could help make you rich. Here’s the surprising thing – Buffett’s wisdom seems so common sense and practical, and yet it can lead to great wealth.

Top 10 investing tips from Warren Buffett

Below are ten of Buffett’s more widely known aphorisms and what they mean for investors.

1. “Rule No. 1 is never lose money. Rule No. 2 is never forget Rule No. 1.”

Buffett’s point sounds simple here, but it’s disarmingly complex. Of course, as an investor you’re trying to profit in the market, but one of the best ways to do that is by avoiding loss. When you eliminate decisions that expose your portfolio to loss, what’s left is more likely to be a gain. When you have more money in your portfolio, you can compound your gains even faster.

This approach has implications for how you invest. Buffett’s quote suggests that instead of looking for the highest upside, you should be looking to avoid loss first and only then look at gains. That’s a different mindset from investors who view the stock market as a slot machine.

2. “It’s far better to buy a wonderful company at a fair price than a fair company at a wonderful price.”

While some value investors focus on buying only the cheapest companies, Buffett suggests a better course of action is to buy “wonderful” companies – those with better economics and competitive positions. Part of the difficulty here is that whereas fair companies may go on sale relatively frequently, the great companies rarely look cheap.

But a company with a good competitive advantage will likely continue to make money over time, and it can bail you out if you purchase at a too-high price. That may not be the case for a fair company, which may falter and never return to your purchase price or beyond it.

Some of the high-quality companies Buffett has invested heavily in over the years include:

- Apple (AAPL)

- American Express (AXP)

- Coca-Cola (KO)

- Moody’s Corp. (MCO)

- See’s Candy Shops

Apple was the largest position in Berkshire Hathaway’s stock portfolio as of 2024.

3. “Opportunities come infrequently. When it rains gold, put out the bucket, not the thimble.”

Here Buffett suggests that when you see an opportunity you need to act quickly and decisively. When the odds are stacked in your favor – such as when stock prices are down significantly – you need to invest heavily, because good prices might not come along again soon.

Buffett often takes this approach when markets are down significantly. He amasses a ton of cash during the good times, and then invests aggressively when stocks plunge. Having a lot of safe cash on hand allows him to use this strategy.

4. “We simply attempt to be fearful when others are greedy and to be greedy only when others are fearful.”

While some investors think investing is a lot about the numbers, Buffett suggests that investing has much to do with the behavior of investors themselves. When investors are greedy and push the prices of stocks to the sky, Buffett becomes fearful, because a market plunge may soon follow.

In contrast, when investors run away from the market or a specific stock, Buffett becomes more interested because prices are cheaper. When stocks are cheaper, they don’t have the same risk as when they’re expensive. And this is how Buffett thinks about avoiding losses.

In early 2020, the market plunged as worries about COVID rattled investors. However, some investors dove into the market amid the fear, and the market rallied furiously off its lows.

5. “The most important quality for an investor is temperament, not intellect. You need a temperament that neither derives great pleasure from being with the crowd or against the crowd.”

Here again Buffett touches on the value of temperament for a successful investor rather than intelligence. Rather than trying to go with or against the crowd, investors should analyze what’s going on in the market, regardless of who likes what stock. By focusing on the objective facts, investors can make decisions that are relatively free of emotion and make better choices.

6. “The stock market is a no-called-strike game. You don’t have to swing at everything — you can wait for your pitch.”

This quote is one of Buffett’s most famous, and it offers the essence of picking your opportunity. You needn’t invest until you find an opportunity that you find attractive, one that meets your standards of potential reward for the risk you’re taking.

Again, Buffett counsels investors to wait until they find an opportunity that is unlikely to lose them money. You don’t have to take any chance on a stock that you don’t find attractive or a business you don’t understand.

7. “If you like spending six to eight hours per week working on investments, do it. If you don’t, then dollar-cost average into index funds.”

Buffett has long advised most investors to use index funds to invest in the market, rather than trying to pick individual stocks. By picking individual stocks you’re working against the pros who have extensive intelligence on companies. In contrast, if you buy an index fund based on the Standard & Poor’s 500 index, you’ll own the market, the target that everyone is aiming to beat.

By all means, if you enjoy investing, then do it, but most investors are going to be well served by using an index fund and especially by avoiding trading in and out of stocks. Another advantage of using index funds – immediate diversification, which lessens your risk. (See Rule No. 1.)

8. “You don’t get paid for activity, you only get paid for being right.”

There’s no shortage of stock market analysts and commentators who are willing to tell you what you should be doing with your money at any given time. Here, Buffett reminds investors that being an active trader who constantly switches from position to position isn’t likely to produce great returns. Activity can feel productive in the world of investing, but the only thing that matters is whether you were right in your analysis.

9. “At the business school, I tell them that they would all be better off if when they got out of school somebody gave them a card with 20 punches on it and every time they made an investment decision, they used up a punch.”

Buffett uses the punch card example to stress the importance of thinking hard about the investments you make. If you only get 20 punches in your lifetime, you’re not going to be taking a flier on a stock you heard about from your neighbor. You should reserve your investments for businesses that you truly understand and where you think you’re paying an attractive price. If you could only make 20 investments in a lifetime, you probably wouldn’t be careless in your buying or selling.

10. “After all, you only find out who is swimming naked when the tide goes out.”

Investing can feel easy at times. Bull markets can last a long time and rallies can be fierce. But Buffett tells us that it’s only when things get tough that we find out who’s really protected and prepared to outlast the storm. At several points in his investing career, Buffett has temporarily appeared out of step with the current climate. But inevitably, the environment shifts and those who once looked smart are revealed to be swimming without their trunks on. Always make sure that your portfolio is positioned to survive a bear market.

Bottom line

While Warren Buffett may be one of most successful investors ever, his investment approach can be shared by many investors, even if they don’t want to spend a lot of time in the market. Focus on implementing Buffett’s principles and you too could become wealthy or increase your net worth substantially.

How to Buy Gold to Diversify Your Portfolio

Gold has been considered a medium of exchange for thousands of years. It’s also an asset some investors might consider adding as part of a diversified portfolio.

If you’re wondering how to buy gold, there are several ways to invest in this precious metal, including buying physical gold like gold bars and coins, investing in companies that mine and produce gold products, and investing in gold exchange-traded funds (ETFs).

Why buy gold

Gold has an emotional attachment that can make it different from other investments. It’s tangible and has been considered valuable for centuries.

Some advisors recommend gold as a way to add diversification to a traditional portfolio of stocks and bonds. Why? One answer is gold’s low correlation to traditional assets, which proponents say can potentially act as a hedge against systemic risk, especially during periods of stress in stock and bond markets. The chart below demonstrates how the yellow metal can see both periods of correlation as well as divergence with the stock market.

Correlation and divergence

But diversification alone is not always the basis for buying gold as an investment. Plus, there’s no guarantee diversification will eliminate the risk of loss.

If you’re considering adding gold investments to your portfolio, you should approach the decision with the same care and consideration you give any of your financial decisions.

How to invest in gold

Gold coins and bars

Traditionally, ownership of physical gold—gold coins, gold bullion bars, and gold jewelry—is one common way to invest in the precious metal. You can buy gold bars and coins from a gold dealer. When you buy physical gold, make sure it meets your preferred purity standards—not all will be pure gold, for example. Gold should come with an assay certificate that verifies the authenticity, purity, and weight of the gold.

Markups and commissions on physical gold sales can be high, and depending on where you live, you may pay sales tax on the purchase as well.

The secure storage of physical gold can also potentially be an issue. Are you willing to keep your gold products at your home, where it may be at risk of theft, fire, or natural disasters? Doing so may involve additional expenses for safes, additional insurance, alarms, monitoring, etc. Some companies offer to store your precious metal for you, and you can consider a safe-deposit box at the bank, but in both scenarios, you’ll be charged a fee and may not be able to access your gold quickly if you need to sell it on short notice. Additionally, should you decide to sell your gold through a gold dealer, the resale price will likely be lower than the market price, also known as “spot price”, because the dealer aim to make a profit off the buy/sell spread.

Gold mining stocks

If an investor does not want to buy physical gold, investing in gold mining companies can also provide diversification to a portfolio. Gold mining companies come in two different sizes: junior and major. Junior miners are companies that are newer or more speculative, often mining unproven claims. Major miners are more established companies with production and infrastructure in place, mining on proven and sustainable claims. Both categories include publicly held companies that you can find using the stock screener on Schwab.com or the thinkorswim® platform.

The theory behind buying gold mining stocks is if the price of the precious metal goes up, the profit margins of the companies potentially go up as well, which may be reflected in their stock prices. But the price of gold is only one component of the underlying value of these companies. Factors like geopolitics, cost of energy and labor, and even corporate governance and central banks can impact the profitability of individual gold mining firms but not necessarily the price of gold. As with any investment, it’s important to do your research before investing, especially if you’re a beginner.

Gold ETFs and other exchange-traded products

Exchange-traded products (ETPs), such as an ETF or exchange-traded note (ETN), can offer exposure to the precious metal, but not all ETPs are alike. Some ETPs buy physical gold, while others invest in gold futures, options, and other investments, such as stocks in gold-related companies, to attempt to mirror the investment profile of owning gold. Performance can vary widely across gold ETPs, as well as expenses and fees, so make sure to conduct research before selecting a product. An ETP’s prospectus will help you understand its investment objectives and the associated risks, along with expenses. You should also understand the tax implications of the ETP and be aware that some ETPs have liquidity restrictions.

Gold futures and options

When investing in gold via futures or futures options, you’re using leverage to establish a position in a larger amount of the commodity than you could with just your initial margin requirement. This can be an efficient way to participate in gold price fluctuations—up or down—depending on whether you’re bullish or bearish on the market.

Gold futures use the spot price of gold and may respond to market volatility. Some investors migrate to them as a possible hedge when stocks become volatile. When investing in gold futures and their options, it’s important to understand the different characteristics associated with the pricing of futures and options. All futures and options have an expiration date and options are subject to time decay, which can significantly impact the value of both calls and puts. Plus, leverage works both ways. It can turn a small amount of money into a large gain, but the reverse is also true—any losses are magnified with smaller price movements, as well as the potential to lose more than your initial investment.

Bottom line on investing in gold